Adapt or fade: The critical turning point for wholesalers

Can wholesalers break free from physical constraints where CD stores could not?

Every month, dozens of craft producers open their doors in America and every few months, we hear of another wholesale distributor consolidation through acquisition. The consolidations aren’t coincidence – they are a warning sign that our decades-old distribution system, like CD stores a generation ago, is buckling under the weight of modern consumer choice.

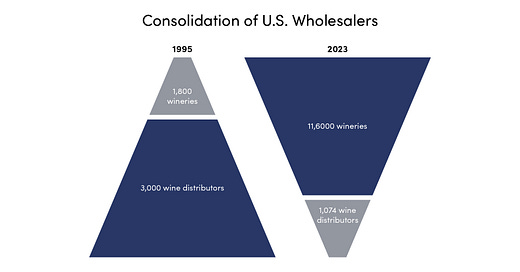

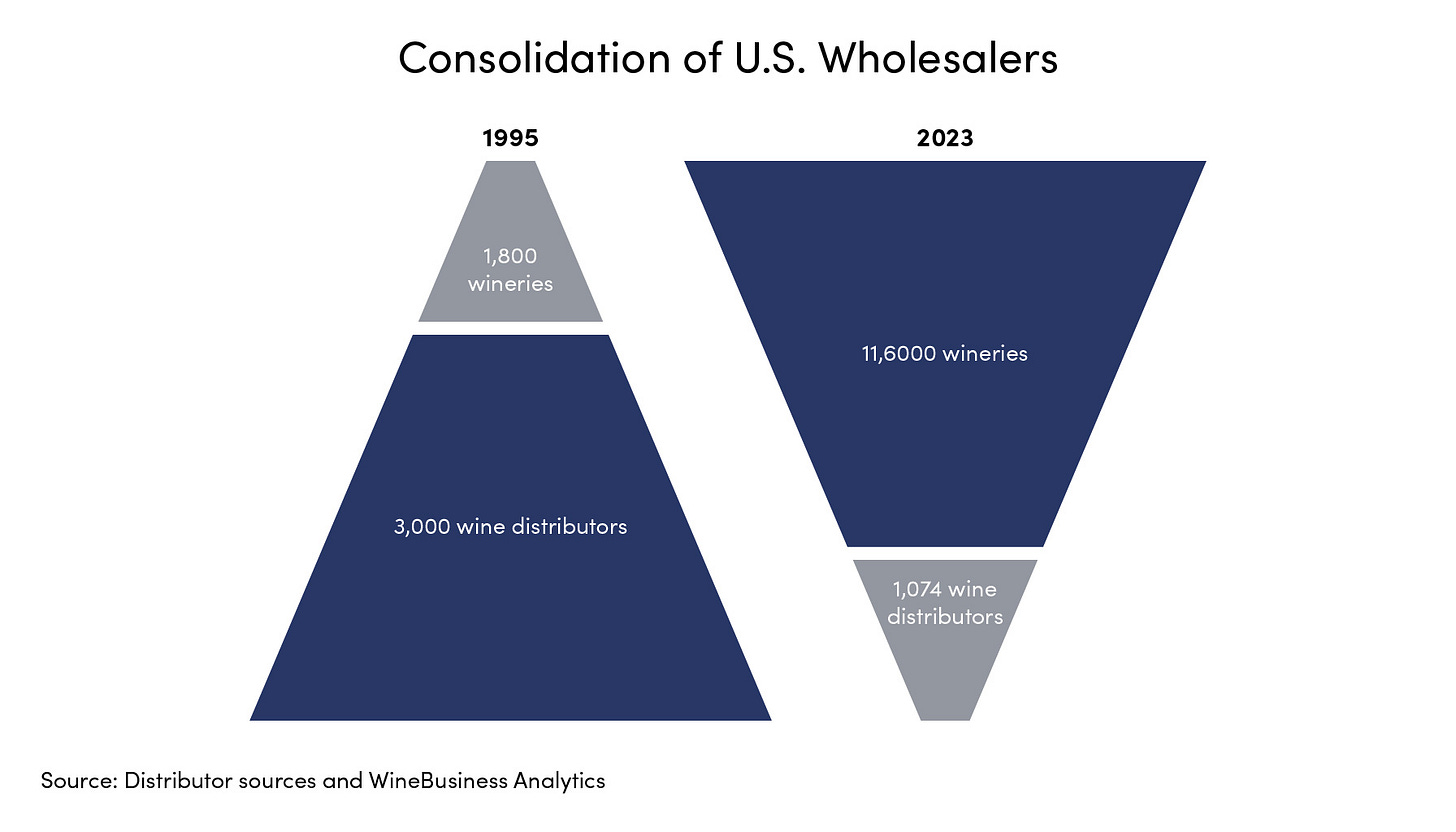

You have to remember the wholesale distribution landscape is quite different than it was 30 years ago. In 1995, there were about 1,800 U.S. wineries and 3,000 wholesalers. In 2024, there were almost 19,000 wineries and only about 1,000 wholesalers, with the top 10 wholesalers accounting for 81.5% of the market.1

The industry is moving from the legacy framework of the three-tier system toward a more dynamic three-channel system that better serves today’s consumer market. As this transition unfolds and consumer expectations grow, wholesalers face significant challenges, many beyond their control. Consider these fundamental constraints on wholesalers:

They are limited by the physical size of warehouses.

Adding a new brand requires removing existing (older or slower moving) brands due to physical space constraints.

Interstate shipping restrictions force them to have multiple high-overhead warehouses to operate across state lines.

Many producers’ production volumes fall short of wholesaler requirements.

Quantity limitations force wholesalers to choose how many brands they can carry or how many SKU’s of each brand they can carry, leaving some SKUs with no distribution.

Sales teams can only maintain expertise across a limited product range.

Specialty and low volume SKUs cannot be feasibly stocked for distribution.

They are burdened with ensuring the safety of the products but have no legal or structural process by which to support this unwritten responsibility.

The parallel with CD stores is striking. Traditional music retailers could stock only about 3,000 CDs – a physical constraint similar to what wholesalers face today. As music options multiplied, more direct market channels emerged as the more logical way to serve consumer demand.

If we don’t modernize the regulatory environment for all channels, including wholesale, our industry will become the victim of “old fashioned ways”. The market will continue to be constrained and shrink.

I have previously written about the concept of the virtual wholesaler and I still firmly believe this is crucial to our industry’s framework. This model will help wholesalers avoid criticism over market access while supporting smaller producers and broadening consumer choice. Franchise states and control states have an even bigger task to modernize because of their badly structured systems.

I was originally told that “come to rest” laws and “ships from licensed premise” requirements were created for managing paper trails for tax reporting. This made sense 90 or even 50 years ago, but today’s technology offers superior tracking and tax compliance. Imagine if any of the wholesalers could dropship product orders directly to restaurants or retailers that have indicated they want the product from a craft producer. This would cut distribution costs and ensure a greater range of products could be offered by wholesalers.

What is dropshipping?

Dropshipping is a fulfillment method where a business sells products without keeping them in stock.For example, when a retailer places an order, the wholesaler forwards the order details to the winery, who then ships the product directly to the customer. The wholesaler never physically handles the product but manages the transaction and customer relationship.

We are seeing signs of modernization. In California all retail trade accounts will soon have to sign up for EFT/ACH payment services to ensure they always pay the wholesaler on time – a good use of technology.

Dropshipping offers a promising path forward for small producers and wholesalers alike, expanding market access and solving distribution bottlenecks. But this transition requires both wholesale modernization and updated regulations that interpret existing rules through a contemporary lens.

The proliferation of the “licensed fulfillment centers” might be the beginning of this virtual wholesaler model. It’s interesting that many states are adding licensed fulfillment centers with wholesaler association support making the claim it will increase the collection of taxes. The fulfillment centers can’t directly impact tax collection as they are not licensed to sell.

However, states are creating a new licensed premise in states that they would not previously been licensed. All of a sudden, a 3PL group could establish a series of fulfillment houses in key states, potentially changing the industry status quo by combining fulfillment and wholesale operations in one building. Modern thinking to an old problem. Ironically, wholesalers may be pushing a structure that will eventually compete against themselves.

Just as CD stores vanished, the old shrinking group of wholesalers may go the same way, while the modern wholesalers (or fulfillment centers) will drive positive change. Not all wholesalers believe in the old ways and many truly want to support the industry, but they are constrained by physical limitations and outdated regulations. As the number of established old school wholesalers shrinks, modern thinkers are ready to step in to provide a modern solution ensuring widespread distribution and allowing the other channels to flourish and build the overall market for wholesale.