If three tier system is ‘Unquestionably Legitimate,’ then so are new direct channels, says the 21st Amendment

The constitutional amendment ratified in 1933 to end Prohibition built a “wall” around states, giving them authority over internal alcohol sales and the ability to open doors to other states.

The 21st Amendment is such a strange document overall; it is the only one that hands over specific rulemaking to individual states. The relevant part for this article relates to Section 2.

“SECTION 2. The transportation or importation into any State, Territory, or possession of the United States for delivery or use therein of intoxicating liquors, in violation of the laws thereof, is hereby prohibited.”

Basically, states get to say if they sell alcohol or not, and if they do, they have sole control of what happens within their own state (unless it violates the Commerce Clause or other constitutional provisions such as the 1st Amendment), but that is as far as it goes. They cannot control or set rules for what goes on in another state.

The Wall was built.

Each state was given complete control over the sale or not of alcohol-based beverages with the state’s ratification of the 21st Amendment (subject to the notes above).

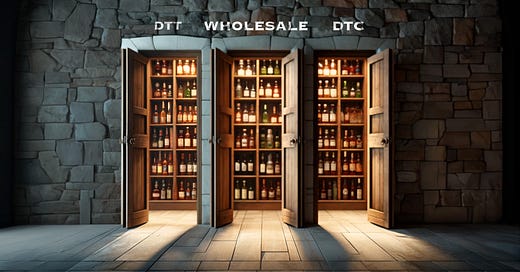

The analogy I have for this is, when the 21st Amendment happened the states got to build a wall around themselves to control what could be sold in their state and how it entered the state. All states then created a door in their wall for the wholesale channel only in the 1930’s.

It has been said, it is the “RIGHT AND THE DUTY for state Legislators to enact such laws as they deem reasonable to regulate the sale, use and consumption of alcohol beverages for the health and safety of its citizens.” – no mention of wholesalers’ rights and duties being exclusive or being mandated.

The sale of beverage alcohol products by states is simple to analyze. Every state has chosen to sell alcohol, it is just a matter of the prescribed system and process of the sale. What we are left with is focusing on the wording “transportation or importation into any state” as they are the only real words remaining as it pertains to the laws “within the state” or as I would refer to it, behind the consumer-isolating wall each state has built with their ratification of the 21st Amendment.

An important item to note when looking at this statement as it relates to the sale, transportation, and importation to a given state – there is no mention of how the alcohol beverage is made, where it is made, or who makes it. That is because the who, where and how is managed at a first level by the TTB, the federal government in simple terms. States can define these things within the walls of their state but due to the Commerce Clause, a growing body of case law including Granholm vs Heald, and even the extraterritoriality rules (you cannot set rules outside of your state), they cannot tell another state producer or seller how to do these things, it is simply out of the states’ jurisdiction. The only addition states have is to dictate what carriers enter their border, but not from where they enter.

Once the 21st Amendment was ratified and states decided to adopt various forms of the three-tier system of producers, wholesalers, and retailers to keep each participant from having common ownership, the system was all set. The first door in the wall for importing was set, a wholesaler could bring product into the state or an instate producer had to sell to a wholesaler. It does not appear to bother states that in many cases this artificially increases the cost to the consumer, with some states even mandating the marks ups to be applied.

Now the history books in general tell you that either the state became the wholesaler (now called control states), or the job of wholesaler at the time was turned over to organize crime syndicates (private businesses). Side note: they were referred to as “organized” crime because at the time they were the best logistics businesses around (organized) because they had managed distribution throughout the prohibition period. In general, organized crime families rose in power at the onset of Prohibition (ironic). Except for ownership of the wholesalers, little has changed in the three-tier system since the 1930’s. There is no motive to modernize. It is like having a government mandated license to print money for these private family run businesses. No wonder they protect their system like the world is about to end.

A big impact in the modernization of the US economy has been the consolidation of the wholesale tier and the market dominance of certain producers. However, the craft industry, and consumers looking for new and interesting products have been mostly ignored. This has manifested itself in demonstrating that the old wholesale channel on its own does not work, and new channels are needed to complement the old wholesale channel that only works efficiently for big sellers and big buyers.

New doors through the wall were opened.

Two new channels have appeared through legislative changes to help with the sale of the craft products. These channels are even utilized by bigger producers for limited quantity/special releases, where possible.

The Federal Government has recognized the need to introduce more competition into the industry as the industry is so lopsided currently in favor of the large corporations. Unfortunately, the federal government is powerless and cannot do anything but stop more consolidation amongst the large players.

However, we do have the development of two new channels. The Direct to Trade (DTT) and Direct to Consumer (DTC) channels have arrived on the scene to bolster the sales channels for the smaller craft producers, and the large producers with limited production products.

The Direct to Trade channel: Some state legislators felt this was exceptionally important to allow their craft producers to be able to sell directly to restaurants and retailers when distribution was not available through the wholesale channel, so they opened a new door in the wall allowing craft producers the opportunity to sell direct. More work is needed to make this available for instate and out of state producers.

The Direct to Consumer channel: Again, a new door was opened by legislators through the wall. This channel is a simple common-sense approach. The channel provides more choice for the consumer who gains access to products not available through the alternate wholesale channel.

The good news is none of these doors are connected. There are now three distinct legislated sales channels available to maximize consumer choice, but all the while maintaining the regulatory compliance needed. With the modernization of commerce in general, all the old advantages of wholesale such as tax collection, order tracking, etc. have been surpassed by the technology and systems available today, and the chain of custody can be measured through the entire transaction.

These two new channels should not be confused as being part of the traditional wholesale channel (fondly called the 3-tier system by some). It is clear in dealings around the country that legislators, regulators, and judges get very confused because of the information they have historically been provided. They mix up the various sales channels and invariably fall back to using the historical three tier system for definitions, not appreciating that DTT and DTC are legislated differently from the original wholesale channel and have different rules. We have seen the wholesale channel even argue that because they do not have the privileges of the new channels, that DTT and DTC channels should not have new privileges. But they should understand, the wholesalers have their old channel, and new players have new channels to work within.

The three channels of distribution.

Now we have three channels to many markets, that are easily licensed, and states get to issue shipper licenses to the appropriate parties in other (foreign) states that are licensed both at the federal and state level.

However, a fundamental legal structure remains, and that is that a state's legislature can open each of these doors to suppliers from other states, but the state opening the door is doing just that, opening the door. The state does not get to say how the businesses are run or how they manage operations in the other states. All they can do is specify that the out of state businesses are licensed at the federal level and in their home state as a retailer or producer – the state does not get to define how another state defines and licenses them, after all, they are only licensing them as shippers. Of course, it does not stop states trying to step outside of their walls and try to tell others what they expect as it pertains to the state’s rules inside the wall, but that is not the way the law works. Simple rules should be followed.

Sellers are licensed.

The licensee is the owner of the product when it enters the state.

Taxes are paid.

Age verification and quantity limit rules are adhered to.

Lack of state understanding the industry and shipping.

State legislators really worry about age verification, licensed sellers, taxes paid, and an auditable system. In a modern economy we quickly discover that there is a lack of understanding at the regulatory and legislative level of even the basics of how businesses in the beverage alcohol industry operate and sell (the structure is set at the federal level), and so rules get introduced and implemented that make little sense and just over complicate matters, building higher operating costs and solving nothing.

A case in point. Most states can obtain manifests (tracking information) from licensed common carriers for alcohol products shipped into their states. Those states who are a little more advanced match those tracking numbers with the tracking numbers supplied by the licensed shippers, and any tracking that does not match they investigate – simple and very effective.

However, those states that don’t require the simple task of sellers providing the tracking number for shipments and even a couple that do, have decided to make things even more complicated, expensive and cumbersome and have started to license fulfillment facilities because the states feel that will solve their issue. There are three things that jump out.

Had the state added a column on their shipper reports to allow the seller to add a tracking number, the state would have all the information they needed.

Having a fulfillment facility send a report is duplicative of the common carrier information and the seller information.

The fulfillment center provides the tracking number back to the seller so they can notify customers of the shipment, so it is easy for the seller to provide all tracking information for matching purposes.

A complete mess is being created with layer upon layer of duplicated information.

If wholesalers had to do the same.

It would be like states saying to the wholesale channel (and maybe they should), “I know X Wholesaler you told us you imported the product, but we don’t believe you and so we are going to have the trucking company send us copies of the manifest as well, but just in case, we are going to have the producer or importer send us the information too”.

It would be silly to do it in the wholesale channel so why do it in the DTC channels (it is not done in the DTT channel). Or maybe, to make it a parity, the wholesale channel should do it as well. Ironically, many 3PL’s (third party logistics) businesses are fulfillment facilities (warehouses) themselves, so are they to also report the wholesale shipments under new legislation?

Will the wholesale associations redline my writing?

I look forward to reading a redlined version of this document by the associations representing the wholesale channel, a trend they appear to have got themselves into. The wholesale associations are working hard to defend their old channel structure while in parallel their biggest contributors are actively working on business strategies to get themselves into the direct distribution model, trying to find ways to legally allow themselves to get small producers’ products around the country – I think they are working on ways to create the “Virtual Wholesaler” that we have identified for the trade transactions. The time is coming.

Unquestionably legitimate.

The three-tier process has been held to be “unquestionably legitimate” as quoted in many law cases since Granholm. For this one specific wholesale channel it is legitimate, but the rules for that channel and how they manage sales through three tiers (producer, wholesale, retail) do not get to spill over and influence the new and innovative sales channels being created by state legislators, namely DTT and DTC. These two additional licensed channels are also “unquestionably legitimate” as they have been created by legislators as new sales channels just like the three-tier system was initially created in the 1930’s.

Claims that the three-tier system is still required to protect the alcohol industry slipping back to the times of the 1800’s in itself is ludicrous. I am sure that everyone would agree that the USA in general has advanced beyond the horse and cart days, the lack of transparency, and the corruption that took place in both government and organized crime. To say otherwise would be to admit that the USA has not advanced and is still living in the 1800’s.

Yes.

While states rights can be frustrating, as in shipping directly to consumers, the US Constitution was built to give all states an equal voice in governance instead of being at the mercy of a runaway federal monstrosity. Our winery would love easy access to each state but we also have to respect the ability of each state to keep the feds at bay as the DC monolith attempts to run roughshod over the country.