CRV – The Unplanned Ripples Effect?

Are labeling requirements helping or harming?

Overview

I have been observing the sudden flurry of updates and notifications about what is required to meet the new California Redemption Value (CRV) requirements. For those of you that have still not heard about this, you can read more here. The bottom line is California is initiating a bottle recycling plan that is expanding to the wine and spirits industry. The consumer is charged a small fee (max 25 cents) in the hopes this drives the consumer to take the bottle to a recycling center to get their fee back after they have consumed the contents of the bottle, box, or can.

While I am all in favor of the important environmental protection goals behind the legislation that expanded the recycling program, it is important to implement the plan in a realistic way that will not damage the industry. A deeper understanding of how producers are impacted may help smooth adoption and overall success for the hardworking civil servants who have been tasked to run the program.

The craft / small wine industry has grown to provide a diverse offering, now including more than 11,000 small to limited production producers. The industry has also grown in breadth. Total US wine production by producers outside California accounted for 20.3% of volume in 2022, up from 9.6%, just 8 years earlier. Many of these small producers sell their wine out of their home state, so with the increase of different state recycling schemes, it is making selling products more administratively difficult and costly for them. These regulations added a new hurdle to starting a wine business.

I have the privilege of working with thousands of producers across the country, affording me valuable insight into the potential repercussions of these regulations on our nation's businesses. Upon examining the bill's endorsements, I noticed there was an absence of endorsements from small business associations or local winery associations. The California Wine Institute was listed as a supporter of the bill, it's essential to acknowledge that they represent only about 8% of the producers but some of the largest players.

Labels

Expanding the collection and remittance of CRV has been proven to increase recycling rates and the programs are supported by many of the environmental agencies. I support the CRV. However, the labeling requirements are completely damaging to the industry.

The one silver lining is bottles filled and labeled prior to January 1, 2024, are now exempt from having to comply with the label requirements. The fee is still due. If it is good for pre 2024 bottles, why even make labeling requirements in the first place? There will be bottles labeled in the next 10 weeks that are going to be released in seven years' time and aged for another 10 without CRV labeling. CRV will still be collected on those bottles, and they are eligible for redemption when uncorked in 17 years. If it is possible for these bottles to be compliant with the new legislation, then why are any CRV labels required?

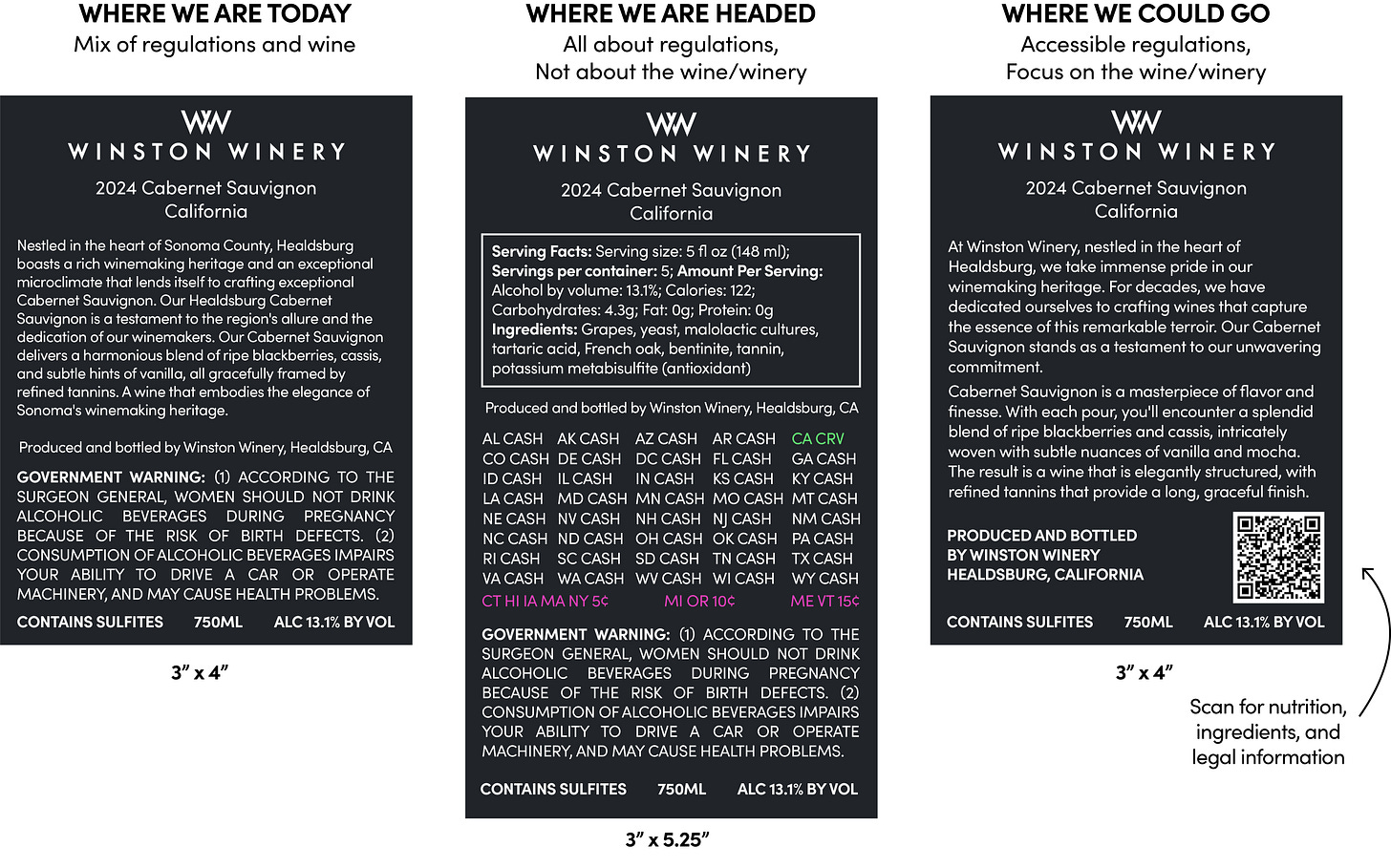

We’ve created some examples of what a label would look like if all states followed California in the labeling requirements, and the potential future requirement of ingredient and nutritional value labeling.

Label real estate for producers is already limited due to the TTB mandated information. Wine labels are an imperative part of marketing and storytelling and including “CA CRV” (and all other states) hinders this. If a producer decides to enlarge their label to fit the new information, it uses more paper, more glue, and more energy to produce, so is contrary to the bills intent.

CalRecycle is not to blame for this. They are the organization that has to collect and enforce these rules. Legislation that impacts a whole industry needs to have opinions from all corners of the industry and should take account of both business and financial impacts.

Financial Review

We are seeing producers canceling their permits for direct sales into the California market because of the implementation of this new labeling requirement and the reporting that goes along with it. Consumer choice is being impacted by these new rules.

Nowhere in the Senate or Assembly analysis did they look into the effect that CRV would have on out of state producers not renewing their CA direct shipper's permit. The loss of permit and tax revenue for the state should have been balanced against the collection of bottle fees from these out-of-state producers.

Here is an example. An out of state winery sells a case of wine to a California consumer at $30 per bottle, $360 for a case. At roughly 9% sales tax that is $32.40 income for the state, plus excise tax. If a producer cancels their license, California now loses that tax income along with the permit renewal fee and CRV fees. The additional label requirement is creating another barrier for free trade.

International Producers

Large international brands can currently deal with USA label requirements because they have the know-how and team to do so. Importers will know the perils of bringing in smaller brands that require add-on importer labels.

The California requirements for “CA CRV” on the label feels protectionist. Again, we will see what CalRecycle says about CRV add-on stickers for smaller brands, much like the importer stickers that are currently being used. Simple sticker or not, it is an added complexity for small producers, importers, and does not help with the marketing and allure of wine.

Legality

Is it even legal to tell a producer in another state or country what they have to do, and if so, is it legal to build a financial burden on others to sell into your state? I am sure some Dormant Commerce Clause folks can weigh in on this.

The Future

Why not take a pause during the 18 months before mandatory labeling is required, think about if it really needs to appear on the label and remove that burden on producers. Remember, excess funds (the difference between fees collected and fees refunded) are being used to educate the consumer to recycle. Typing “CA CRV” on a label does not drive behavior, education does. Those other states that are thinking about bottle bills should learn quickly from the errors California is making and rethink their plans.

Meanwhile legislators in California should really look at this legislation and see if it is really the right thing to do, and if not then roll it back and look at better ways to collect fees and not disrupt an industry due to label changes. A 10 cent recycling fee on a $60 bottle of wine is not the issue, it is the labeling and collection that is the problem. Adding a 10 or 25 cent fee that is collected by the California Department of Tax and Fee Administration (CDTFA) at the same time as sales tax makes for a much smoother system.